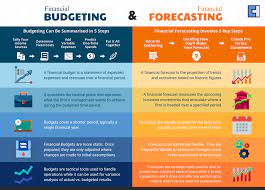

Business budgeting is the practice of forecasting future income and expenses for an organization over an anticipated time period, in order to assess its likely performance throughout its financial year and whether or not its growth goals can be reached.

Every business has unique expenses, but certain costs must be covered regardless of industry or size. These may include rent, electricity and water consumption, office supplies, insurance premiums, accounting services, Internet services and phones as well as potentially hiring a janitorial staff to keep workspace tidy. When developing a budget for any organization it is crucial that all expenses past and expected are documented and created into an appropriate list for the next fiscal year.

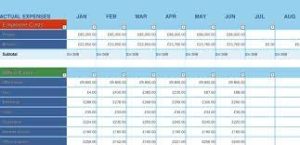

Businesses can save money by comparing estimated spending with actual spending and making adjustments as needed. For instance, if a rent bill for the month is unexpectedly high, they should find more cost-effective office space or reduce other expenditures that directly relate to office operations. In case revenue does not meet projections, companies might need to cut spending on marketing or hiring more employees.

Once a business has compiled its anticipated expenses, they can then compare this list against its projected revenue projections and compare the difference to their costs; the goal should be for this number to exceed those associated with goods and services purchased for use within their operation. This process is known as profit calculations.

Based on this profit goal, businesses can determine how to utilize the profits. For instance, if they can increase profits without increasing expenditures, this might allow for investments such as advertising or product development that help expand the business. Conversely, unprofitable product lines could be discontinued and savings used towards improving more popular lines of products.

Budgets also help businesses plan for future needs, including expansions and potential investment opportunities. They allow the business to determine how much revenue is necessary to fund an expansion as well as estimate materials, employees and space requirements in order to meet this goal. With this information at hand, a business plan or loan application may be developed for future funding requirements.

One way of saving money while running a business is keeping track of when bills are due, either by writing them down on a calendar or setting reminders on smartphones. Failing to pay bills on time could result in late fees and interest charges being assessed;

Budgeting can be a challenging undertaking for small businesses, but it is imperative to get underway and stay on top of expenses to ensure the business stays on solid footing. With an effective business budget in place, a small business can save money on both fixed and variable expenses, plan for unanticipated expenses and analyze trends in its sales and profits, all which could mean the difference between a struggling and profitable venture.