The global cost of living crisis is having an adverse effect on public health with many unable to afford basic necessities like food and fuel, especially those on low incomes or living with long-term conditions. Consumer spending in the UK has decreased due to this crisis resulting in adverse business impacts.

High energy bills, food price inflation and the Russian invasion of Ukraine have all played major roles in precipitating this crisis. Many individuals have lost significant portions of their disposable income and must choose between paying bills or buying food – this forces people into less fulfilling lifestyles while restricting access to healthcare services.

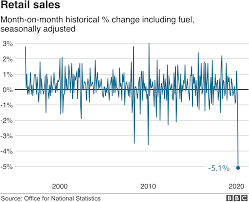

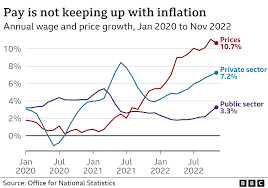

UK households are experiencing one of their greatest financial strains ever seen in generations. Due to rising inflation while wages fail to keep pace, consumers’ purchasing power has decreased by PS50 billion since October 2021 – and with rates set to increase further and inflation continuing its upward trajectory, households could experience further erosion before spending power begins recovering.

Short term, the cost of living crisis will lead to increased demand for goods and services in areas such as housing and food, driven primarily by Russia’s invasion on global supply chains which has already led to some retailers raising prices and cutting back stock levels.

Consumers have shown remarkable resilience throughout the cost of living crisis; however, in the long term this could lead to reduced household spending that in turn may impact businesses negatively. Health providers are already struggling with patients having to visit hospital less frequently while many social care users have reduced the frequency of visits due to limited transport options.

The cost of living crisis will have lasting repercussions in society, particularly amongst those most at risk such as seniors, those living with long-term conditions

such as cancer or asthma, young children and disabled individuals. Low income individuals may also feel the effects, as they tend to devote a greater proportion of their funds towards essentials like food and energy and have less room to increase expenses. These people are at greater risk of experiencing a decline in their state of wellbeing, which has an adverse impact on the level of support from healthcare, social care, and voluntary organizations. If efficiency savings cannot be identified then services provision may have to be reduced as a result. Public health will be severely impacted, as this has an adverse impact on both physical and mental wellbeing of our nation. A plan must be devised in order to safeguard and promote the wellbeing of those most at-risk within society – this requires cooperation among government, local authorities, businesses and community organisations.