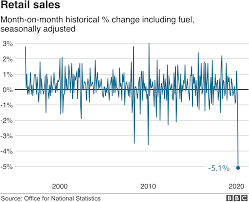

Retail sales dropped to their lowest point since February 2021 as cost-of-living pressures, poor weather and reduced footfall took their toll on consumer spending. According to data provided by the Office for National Statistics (ONS), goods purchased online and offline both fell by 0.3% month-on-month last month – more than twice what analysts had forecast and marking retail sales’ lowest level since the Covid-19 pandemic began in 2020.

Danni Hewson, head of financial markets research for AJ Bell, stated: “Despite decreasing headline inflation rates, household budgets continue to be pressured from all angles. Rising energy costs, higher food costs and an expanding housing market are all taking their toll on household finances, forcing people to tighten their purse strings and spend less on non-essential goods. As a result, consumers are making choices to limit spending.”

Retail sales have taken a serious hit this holiday season as consumers opt to save instead of spend freely. We expect this trend to persist well into 2019, diminishing retailers’ expectations of sales revenue growth.

Retailers attributed their poor performance to factors including inclement weather, increased costs of living and diminished footfall. Clothing and household good stores reported sales volumes fell 1.1% after experiencing a 2.1% decline the prior month; fuel sales also saw decline due to increasing costs discouraging customers; food sales also saw decrease as consumers focused on essential purchases over treats; however non-food store retailers saw sales rise 0.8% due to rebound sales at jewellery and watch stores.

Online retailing experienced a 0.8% sales volume increase due to various factors. An unseasonably warm start to October delayed purchases of winter warmers while rain reduced footfall at the end of the month. Furthermore, shoppers may have taken advantage of discounts and promotions from retailers like Amazon Prime Day to take advantage of them and boost online retailing sales volumes further.

The ONS report noted that although sales volumes decreased slightly in October, their value remained consistent – this suggests the UK economy experienced around one percent growth during this quarter when compared with its prior one. On Wednesday, GDP figures may be revised down after initial estimates suggested the UK experienced negative GDP growth during Q3. An economic downgrade would add further concern about the health of the global economy, particularly at a time of increasing climate emergency that has already led to increasing utility costs, insurance premiums and food costs. The ONS data follows a sudden slowdown in the US economy, compounded with rising house prices and an overheated stock market. This has amplified fears of another recession – many Americans now fear losing their jobs or seeing their stock investments collapse altogether.